School Funding

Your donations to SCEF also supports the activities and programs of your school PTA. Your PTA will use these funds to pay for classroom supplies, teacher stipends, community events, and important advocacy for schools. Please go to your school website to join your PTA. You can learn more about SCEF and PTA and how your support of these important organizations helps schools have what they need to provide enriching programs and exciting experiences for students.

Community and Business Partners

Local businesses and community organizations also play a key role - offering donations, grants, and partnerships that expand opportunities for students both inside and outside the classroom.

Working Together for Our Students

When we talk about "school funding," we are really talking about the incredible people and community groups who step up to support our students. Every dollar - whether it's from the state, local taxes, SCEF, PTAs, or our business partners - helps us create safe, engaging, and high-quality schools for all.

Understanding How Our San Carlos Schools Are Funded

SCSD is a state-funded (LCFF) district. However, this state funding only accounts for 75% of what our schools need to be successful. Nearly 25% of the funding for our district comes from local sources – property taxes, local parcel taxes, and parent and community donations through SCEF and school PTAs. Maintaining the high standards for education we expect for our students is a community effort.

What Does It Mean to Be State (LCFF) Funded?

The state of California determines if a district is to be LCFF or Community Funded based on the underlying property tax revenues. The state sets a “per pupil” minimum funding requirement. If a district has enough property tax revenue that it meets this minimum then it is considered to be “Community Funded” and the district receives all of its funding from local property taxes – and has the ability to keep any dollars that exceed the minimum.

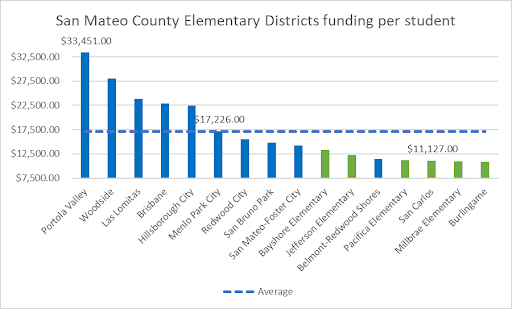

If a district does not have enough property tax revenue to be able to fund the “per pupil” minimum mandated by the state then the district is considered to be LCFF (Local Control Funding Formula) and is state-funded to that minimum per pupil with no opportunity for the district to keep any extra monies generated by property taxes. In general, Community Funded schools in our area have higher per pupil funding because of this formula (see DISTRICT NAMES, chart below).

At this point in time, San Carlos does not generate enough property tax revenue to qualify to be Community Funded so the majority of San Carlos School District revenue (75%) comes from the state of California in accordance with the Local Control Funding Formula (LCFF).

Community-Funded Districts:

- Previously known as “Basic Aid” Districts.

- Derive ALL funding from local property taxes.

- Able to keep property tax dollars that exceed the per pupil minimum set by the state.

- Often still have foundations that raise money for their schools, and active PTAs that raise money and support programs and activities.

State-Funded Districts (LCFF):

- The State of California funds the minimum amount per pupil, based on enrollment.

- No ability to keep extra property tax money.

- In San Carlos, LCFF funds do not match funding of surrounding districts leading to disparities in funding up and down the Peninsula and throughout the state.

- San Carlos relies on its educational foundation (SCEF) and PTAs to help bridge the gap between state funding and what our schools need.

- LCFF status is evaluated annually.

This chart illustrates that San Carlos remains one of the lowest funded districts when compared to neighboring communities.

Local Districts Revenue per Student

Learn more about why school funding in California - the fifth largest economy in the world and the wealthiest state in our nation - is inadequate by clicking here.

Understanding Budget Development

Our priorities in approaching budget development:

- Transparency

- Collaboration

- Informed decision-making

The San Carlos School District strives to have a transparent budgeting process, encouraging parents to understand how the district is funded, what affects funding, and how and why decisions are made. During the school district’s budget development process all factors are taken into consideration as information develops from the county, state and larger economic trends. Salary and benefits continue to be the largest expense faced by our district, consuming 82% of all budgeted dollars, in the coming years this number is expected to increase. The district budget is approved every June by the school board for the following school year. You can participate in the on-going discussions and find budget documents in the School Board portal.

During the school district’s budget development process all factors are taken into consideration as information develops from the county, state and larger economic trends. Salary and benefits continue to be the largest expense faced by our district, consuming 82% of all budgeted dollars, in the coming years this number is expected to increase. You can learn more about the budget on the SCSD Business Office.